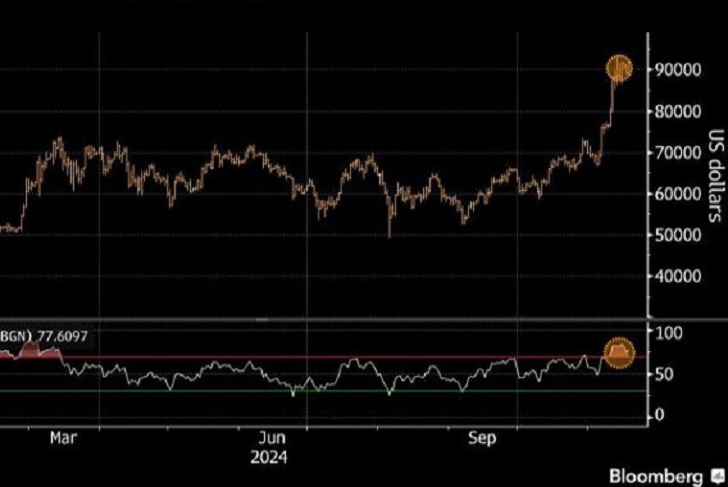

Bitcoin’s surge to $90,000 has captivated investors worldwide, marking a significant milestone for the digital asset. Following Donald Trump’s election win, the largest cryptocurrency’s value has risen by about 33%, reaching an all-time high of $89,968 on various exchanges. Traders and institutions alike are capitalizing on this momentum, betting on favorable policies that may drive further growth for Bitcoin and other crypto assets.

Trump’s Pro-Crypto Policies Spark Investor Confidence

Under Trump’s leadership, expectations of a friendlier regulatory environment for crypto assets are high. The Republican-dominated Congress strengthens his chance to introduce policies that could further bolster digital assets. Trump has pledged to create a strategic Bitcoin stockpile and encourage domestic mining, aiming to establish the U.S. as a leader in the global crypto landscape. This policy shift has injected new enthusiasm into the market, with institutional and retail investors fueling Bitcoin’s rally.

Al Jazeera | MSN | Under Trump’s leadership, expectations of a friendlier regulatory environment for crypto assets are high.

Institutional Adoption at an All-Time High

The surge in Bitcoin’s price isn’t solely driven by retail speculation; institutional adoption is climbing as well. The open interest in Bitcoin futures and options on major exchanges like the CME Group has reached unprecedented levels. Institutional players view Bitcoin as a potential hedge against inflation and a means of portfolio diversification. With more regulatory clarity anticipated, funds increasingly allocate capital to digital assets, enhancing Bitcoin’s position in the financial ecosystem.

Bitcoin’s Market Cap and Liquidity Surge

The overall value of digital assets has now surpassed $3.1 trillion, driven by Bitcoin and other top-performing cryptocurrencies. Trump’s promise of a pro-investment stance, including relaxed regulations for crypto firms, is making digital assets a mainstream investment choice. Crypto companies are also benefiting from the liquidity surge, attracting global capital. Smaller tokens, including Dogecoin, have also experienced record-breaking gains, reflecting the optimistic outlook in the cryptocurrency sector.

ETF Demand Amplifies Bitcoin’s Rally

Bitcoin’s rally is also fueled by a strong demand for exchange-traded funds (ETFs) dedicated to the asset. In the wake of Trump’s election, ETFs saw substantial inflows, signaling an uptick in long-term investor interest. BlackRock’s iShares Bitcoin Trust hit record turnover, highlighting the increasing engagement of institutional investors. ETFs offer a convenient gateway for investors who want exposure to Bitcoin without directly holding the asset, contributing to its liquidity and price resilience.

Bloomberg | MSN | Bitcoin’s rally is fueled by a strong demand for exchange-traded funds dedicated to the asset.

Corporate Interest Adds Fuel to the Rally

MicroStrategy, a prominent corporate holder of Bitcoin, recently acquired an additional 27,200 Bitcoin, totaling approximately $2 billion in value. This acquisition underscores the growing corporate interest in Bitcoin as a store of value. Since the election, MicroStrategy’s shares have skyrocketed, showing that investors believe in Bitcoin’s potential as an alternative asset class. Other corporations may follow suit, further solidifying Bitcoin’s role in institutional portfolios.

Predictions for Bitcoin’s Next Move

Market sentiment suggests Bitcoin could soon reach $100,000. Deribit’s options data reveals that investors are increasingly betting on this milestone by year-end. Options traders are targeting the $100,000 strike price, reflecting the market’s bullish outlook. Analysts believe that with sustained demand from ETFs, institutional flows, and Trump’s pro-crypto stance, Bitcoin’s ascent may continue.