Are you looking into buying a car or putting that down payment in for that house you want? Maybe you want to treat yourself and your family to a good vacation? Well, though it may not be an easy task, it isn’t impossible either. Achieving these milestones will require you to save money and cut down on extra spending.

Pexels | Denying yourself these pleasures might not feel good at the moment, but later on, you’ll be thanking yourself

So, now that you’ve decided that you want to save money for your goals, where do you begin? It is unfortunate that when you’re younger, you get to learn about almost everything under (and near) the sun, except for specific essential skills that are extremely important for your adulthood, like personal finances, taxes, interests, and debt management.

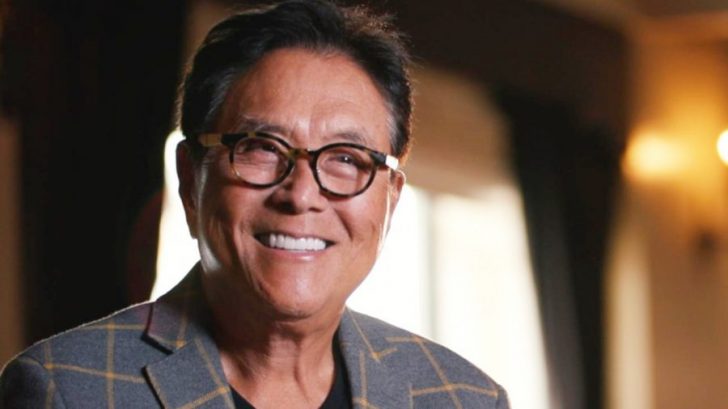

However, there’s a lot of literature now available for you to learn the philosophy of finance management, and one of those books happens to be ‘Rich Dad, Poor Dad’. This book is written by Robert Kiyosaki and Sharon Lechter and it gives out some useful lessons for saving money. We’re covering a few of them.

Fintech Zoom | The poverty and cultural diversity Kiyosaki witnessed from a young age had a huge impact on him

1. Work Smart, Not Hard

For an average middle-class person, the journey to a financially stable life includes them going for higher education which would allow them to make a sizeable earning while, on the other hand, wealthy people generally invest their time and capital into something that would “earn for them”. A good example would be investments in property, stocks, or business ventures – basically any avenue that can help you swell your earnings.

2. Educate Yourself in Finance

This book tells you that your greatest asset isn’t going to be a fancy bank statement but your financial education. You can have all the money in the world but if you are not capable of handling it, it won’t be long until you lose all your capital. However, if you have awareness regarding finances and how they work, you can use your knowledge to gain money. Kiyosaki argues that money without financial intelligence is doomed but it is your financial intelligence that can generate more money.

3. Reduce Your Liabilities

What is a financial liability? These liabilities are the debts, loans, trade payables that you get in order to pay off a transaction. Here is a simple example: right now, you reside in a comfortable 2-bedroom house but you’ve recently got a raise so you decide to take out a loan in order to get a bigger house.

This loan that you are taking is a financial liability. Sometimes, they are not avoidable and you have no choice but to go with them. But most of the time, they are quite avoidable and result from your temptation to get a lifestyle upgrade.

Pexels | The urge to spend might be strong but you have to resist

While the book offers a lot more information and education regarding financial education, here are only a few of the lessons everyone needs to learn.